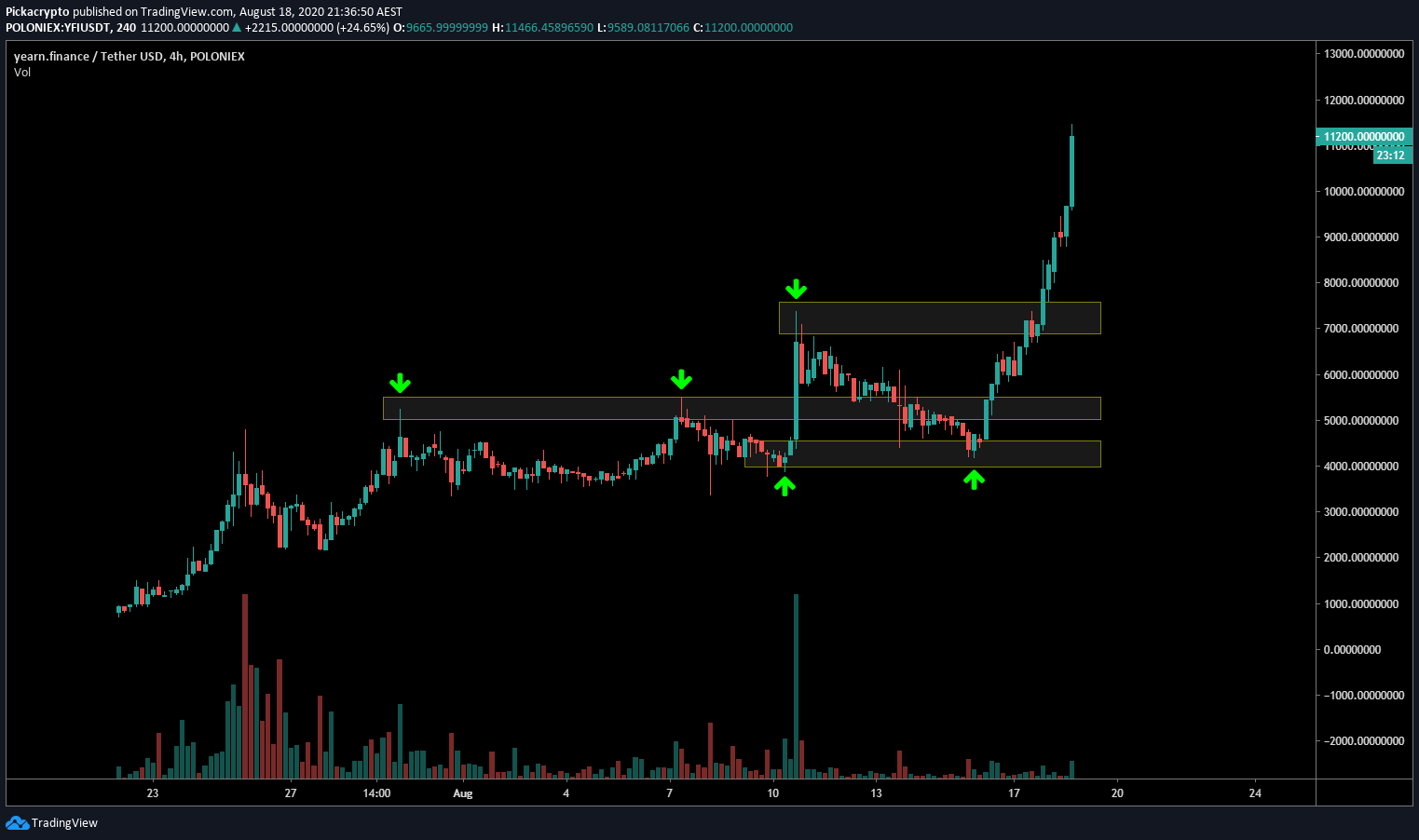

Yearn Finance seemed to run out of steam as the start of autumn continued the downtrend. (Yearn Finance token rose as high as $43,678.11 and afterwards fell to $21,383.77) In the coming weeks, Bitcoin slowly gained momentum and altcoins also rallied, but eventually saw major corrections, with YFI shedding more than half of its value. YFI was listed on Coinbase, a major boost to the coin as it surged during the days beforehand. (YFI eventually hit about $39,000 on the last day of August) The price per token overtook Bitcoin as YFI continued to rise. Yearn Finance started gaining more momentum and interest in the YFI token soared. (YFI swiftly rose to a peak around $4,500 on 25 July, before a market correction) The token was distributed to Curve ypool and YFI Balancer pool investors who had deposited assets in the first week of the pool's launch. Yearn Finance’s YFI token was released with practically no value. The low quantity of tokens, as well as services such as yield farming and lending aggregation, meant the token’s demand rose quickly and at one time, the price even surpassed that of Bitcoin. His decision to rebrand and hand over the development and control to nine people turned the platform around. At that time Cronje was single-handedly running the protocol. Before being rebranded to Yearn Finance, the platform was the subject of an exploit that had left many people disgruntled. The rise of YFI has caught many people off guard. This has propelled the token’s value and as of early August 2021, YFI has a price tag of more than $31,000 Key News for Yearn Finance The tokens are very scarce (36,666 in total) and were completely distributed to selected early investors.

Like the plethora of other DeFi projects, Yearn Finance has its own governance token, YFI, but it comes with a little twist. A rebranding and shifting developer control over to nine different people turned the project around. A Brief History on the Price of Yearn Finance All in all, this protocol targets investors who don’t have the time to study the increasingly complex DeFi phenomenon from scratch and those that wish to optimize their returns. The fees charged vary over time and can be changed by consensus among the community. The protocol makes its money by charging withdrawal and gas subsidisation fees. Incredibly, new features continue to be rolled out, and these aim to help preserve the platform’s long-term value. The platform makes use of various tools to act as an aggregator for DeFi protocols such as Compound, Curve, and Aave thereby bringing those that stake crypto the highest possible yield. What makes Yearn.Finance special is how it simplifies DeFi investment and activities such as yield farming for the broader investor sector. Andre Cronje is the brain behind this protocol. The protocol was previously known as iEarn and has seen tremendous growth over the past few months, thanks to the launch of various products and the release of the YFI token. So the project caters to the investor who lacks the know-how but wishes to interact with yield farming in a less committal manner than serious traders.

The protocol aims to simplify the ever-expanding DeFi space for investors who lack the technical understanding needed to interact with various platforms in the space. It serves DeFi investors by automating yield farming for maximum returns. Launched in February 2020, Yearn.Finance is an aggregator service for decentralised finance markets.

0 kommentar(er)

0 kommentar(er)